I'm a startup investor and entrepreneur. I spend my time thinking about high-growth businesses and working with founders to support their journey. I also help companies create data-driven strategies, develop compelling products, manage talent, and raise capital. I enjoy building things, cultivating community, and coaching leaders. This site is a collection of some of my thoughts and work. I typically write about startups, venture capital, and leadership.

Latest Thinking

Featured

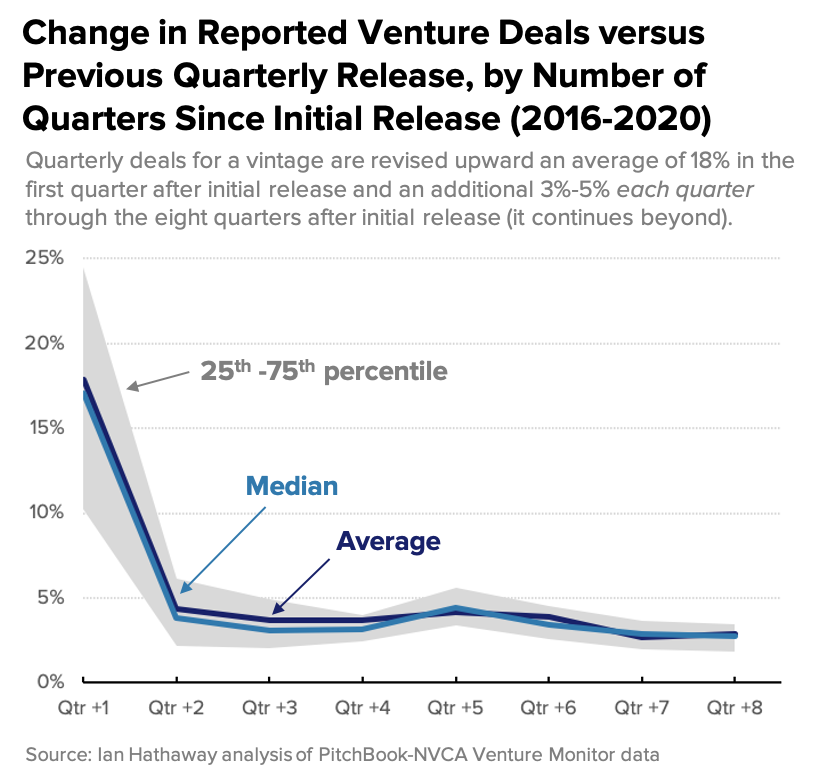

Venture Capital, COVID-19

U.S. Venture Deal Activity during the COVID-19 Pandemic

Venture Capital, COVID-19

Venture Capital, COVID-19

Latest News

Featured