WeWork’s calamitous IPO process may have moved into a new phase on Friday, as news reports claimed that the company is considering a valuation as low as $10 billion. That’s a far cry from an initial target of $47 billion—a figure that would match the company’s post-money valuation at the time of its most recent venture financing in January.

A lot has been discussed about WeWork in recent weeks. There are vocal critics who say that the company is a disaster—that it is massively overvalued, its governance practices are irresponsible, and its pathway to profitability is hopeless. Others say that the WeWork is deeply misunderstood and that the company is a disruptive innovation. Some say WeWork is not even a tech company; others say it is.

There is good reason to believe WeWork has a challenging path to profitability, that the company is overvalued, and that its public offering is in jeopardy. I don’t want to rehash all of that today. Instead, I’ll illustrate the (allegedly) remarkable collapse of WeWork’s valuation and place it into a broader context with other companies.

To begin, let’s quickly review WeWork’s fundraising history. The table below shows equity financing rounds beginning with its first seed financing in October 2011 up to the pending initial public offering that was first announced in August. I excluded the $3 billion in SoftBank secondary share purchases and at least $1.8 billion in non-convertible debt.

Included for each funding round are the deal date, amount, post-money valuation, total equity capital raised to date, and invested capital multiple. The “IC Multiple” is calculated as post-money valuation divided by capital raised to date. It can be thought of as a rough measure of gross returns (or capital efficiency if you like) since it’s a ratio between the value of the company and the capital it has raised to get there (“money out / money in”).

As WeWork raised more capital, the company’s valuation grew—and from the beginning through Series E, the valuation grew faster than did the amount of capital going in. This is visualized by the IC multiple, which increased from 3.9x at Series A through the peak of 10.2x at Series E. After that, its valuation continued to grow (numerator), but at a slower pace than the amount of capital going in (denominator)—hence, the falling multiple (ratio). This also meant that, relative to the past, WeWork had to give investors a higher share of the company for each dollar coming in (a lower price).

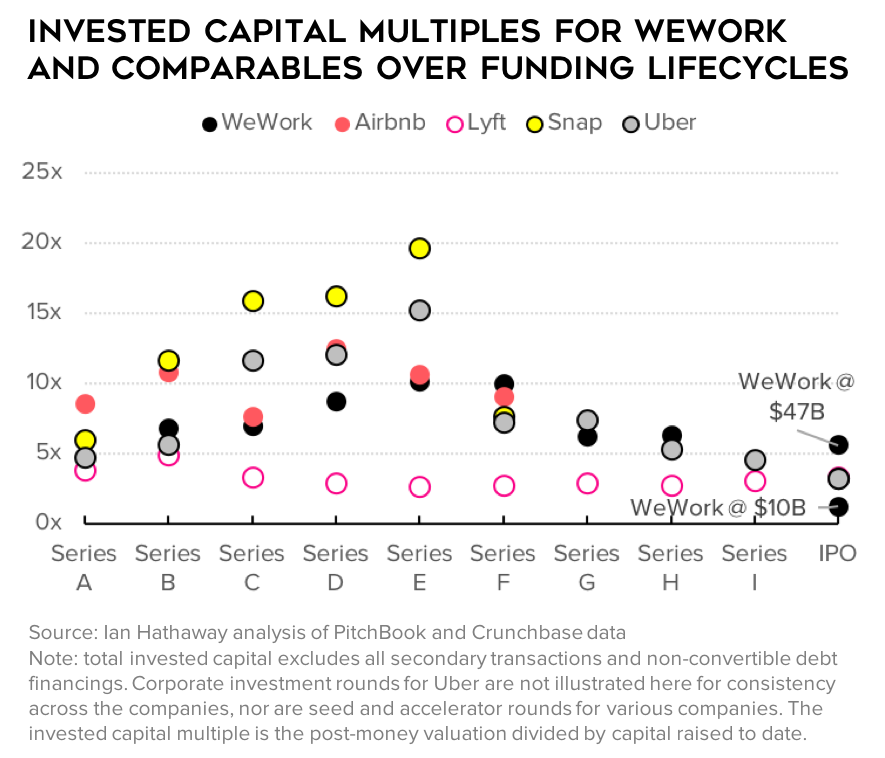

A falling IC multiple is not uncommon among middle-to-late stage companies that raise a lot of capital. To put things into context, here is WeWork’s IC multiple alongside of a few comparable companies—three that went through an IPO already (Lyft, Snap, Uber) and one still privately-held company that is on its way to a public offering (Airbnb).

All but one company follows a similar pattern—growth in valuations that outpace growth in capital invested (an increasing IC multiple) from Series A through Series D-E, at which point things flip as companies raise increasingly more capital ahead of an IPO. Lyft is the exception here as its IC multiple held relatively flat throughout.

So, WeWork’s falling IC multiple on the way to an IPO is not unusual, and in fact, it moved relatively steady compared to both Snap and Uber—both had large drops in IC multiples after Series E, before trending slowly down from there towards IPO.

What’s unusual about WeWork is what’s happening right now. Let’s zoom in a bit from the chart above and look at total capital raised, post-money valuation, and the IC multiple (the ratio of the two) for WeWork under the announced $47 billion valuation, the rumored lower valuation of $10 billion, and the actual figures for the IPOs of Lyft, Snap, and Uber.

The initial target post-money valuation of $47 billion at IPO would produce an IC multiple of 5.6x, making WeWork the star of the group. However, if WeWork were to go public at a $10 billion valuation, then the IC multiple plummets to 1.2x—a middling return over the life of the company. For WeWork to achieve a multiple equal to the three-company average of 3.3x, it would have to reach a valuation of $28 billion. That seems unlikely now.

One question that rises to the surface is: is WeWork is too late in getting public? Given the beating that tech stocks like Lyft and Uber have taken in public markets since their IPOs, it’s fair to ask if investors are simply getting ahead of what’s to come. But even there, WeWork looks like an underperformer overall.

If one were to construct an “alternative IC multiple” which takes market capitalization of each of Lyft, Snap, and Uber today, and places that over their capital raised through IPO, they would still outperform what’s shaping up for WeWork—Lyft’s multiple would fall from 3.3x to 1.8x, Uber’s from 3.2x to 2.4x, and Snap’s would increase slightly from 3.3x to 3.7x. I realize these are not perfect comparisons, but they are directionally correct.

WeWork looks like a company that has been massively overvalued in private markets—particularly of late. Public markets look unprepared to continue that trend. Look no further than this Wall Street Journal article on Friday that shows SoftBank is prepared to prop-up a significant portion of the IPO. That’s wouldn’t happen if investor demand was there. It’s fair to question if the IPO happens at all. UPDATE (Sept 17): hours after this posted, the company announced plans to delay the IPO until at least next month.

WeWork wasn’t always this way. Throughout much of its lifecycle, the company exhibited rather modest growth in valuation to capital injection ratios. That changed dramatically in the last few years as SoftBank started pumping large quantities of equity and debt into the company, and gobbling up shares held by earlier investors and employees through secondary transactions. An examination of the data suggests the final round of financing in January—where SoftBank singlehandedly doubled the amount of capital raised by the company and doubled its valuation—is what may have thrown the whole thing off.

SoftBank, of course, looks like the big loser here. Not only did it single-handedly account for most of the latest-stage capital going into the company through both debt and equity—including the big round in January which may have undermined the entire pathway to a smooth IPO—but it also made a staggering $3 billion in stock purchases via secondary transactions. For more on what that means for SoftBank, read this from Chris MacIntosh.