In the last couple of weeks, the subject of Canada as a rising startup and tech hub has been seemingly everywhere in my news feed:

Brad Feld posted a blog titled “Canada Is Going To Be The Next, Great, Entrepreneurial Tech Country” last Thursday

Brad’s post was motivated by an April 20 Bloomberg News article “Engineers Are Leaving Trump’s America for the Canadian Dream”

Two days ago, Foundry Group, Brad’s venture capital firm, announced an investment in Toronto-based Golden Ventures

Also two days ago, Fred Wilson wrote about his love of Canada and how active his firm, Union Square Ventures, is in the country

Also this week, Amazon announced it would be expanding its footprint in Vancouver by 3,000 workers

And finally, although it was announced back in March, I just learned yesterday on Twitter that Silicon Valley Bank is opening an office in Toronto—its first in the country.

I’m sure that I’m missing a bunch, but that’s a lot of news in a short amount of time.

Much of the discussion about Canada has focused on Toronto and Vancouver, and to a lesser extent Montreal (where Techstars is opening a new accelerator, one year after launching in Toronto). And that’s for good measure—these are far and away the leading hubs of startup activity in Canada. They're big, and they're active.

But, I’d like to talk about another northern star that shouldn’t be left out of the discussion: Waterloo.

Many people consider Waterloo to be integrated into the broader Toronto region, but that’s not fully correct. I’d liken it to the Boulder-Denver region—integrated but distinct. Some people I've spoken with in both places agree.

I’m currently working on a global venture capital research project, and while I don’t want to give too much of that away right now, I thought it was worth sharing some venture capital trends in leading Canadian metropolitan areas.

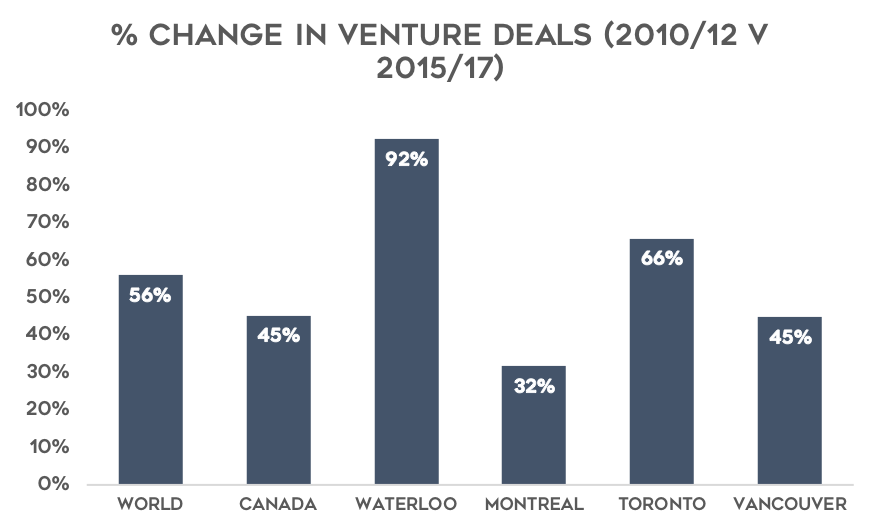

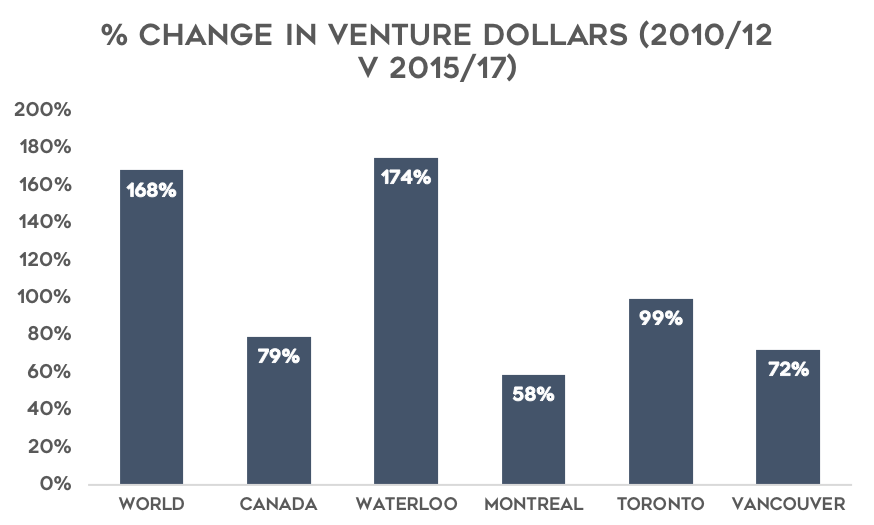

The table here shows data on venture deals and capital invested during two periods: 2010-12 and 2015-17. I have grouped the data into three-year periods to smooth noisiness in the data from year-to-year, which is a factor for smaller cities (and for the report). Also included are population and “density” measures (deals and dollars per resident).

Most Canadian venture capital investments go to three places—Toronto, Vancouver, and Montreal captured 68 percent of Canadian deals in 2015-17 and 73 percent of capital ($) invested. Those numbers are up slightly from 2010-12 (at 65 percent and 72 percent, respectively), so these three cities' share of the Canadian venture capital market is growing.

Compared to growth of venture capital globally, these three cities are performing about average. Waterloo on the other hand, is growing at a faster clip. Though accounting for just 5.2 percent of Canadian deals in 2015-17, Waterloo increased its country share by one-third versus five years earlier. Venture dollars invested in Waterloo expanded even more—capturing 7.3 percent of the Canadian market, compared with 4.8 percent five years earlier.

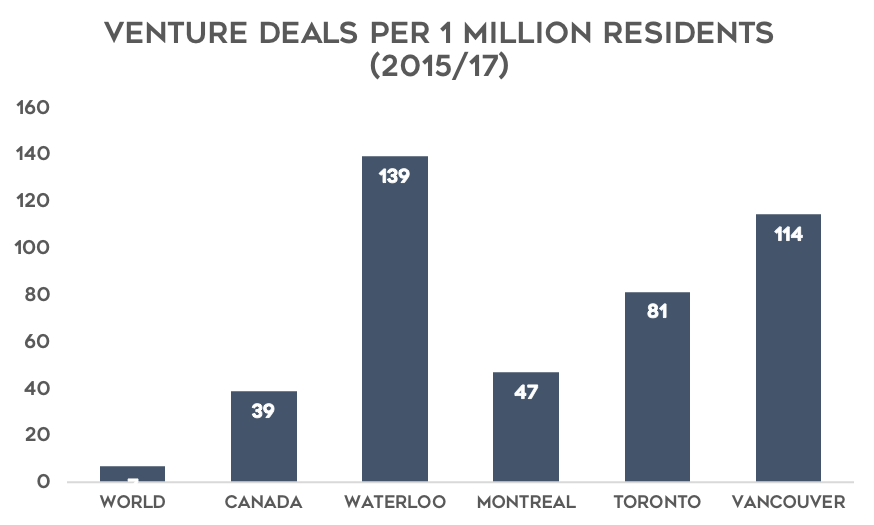

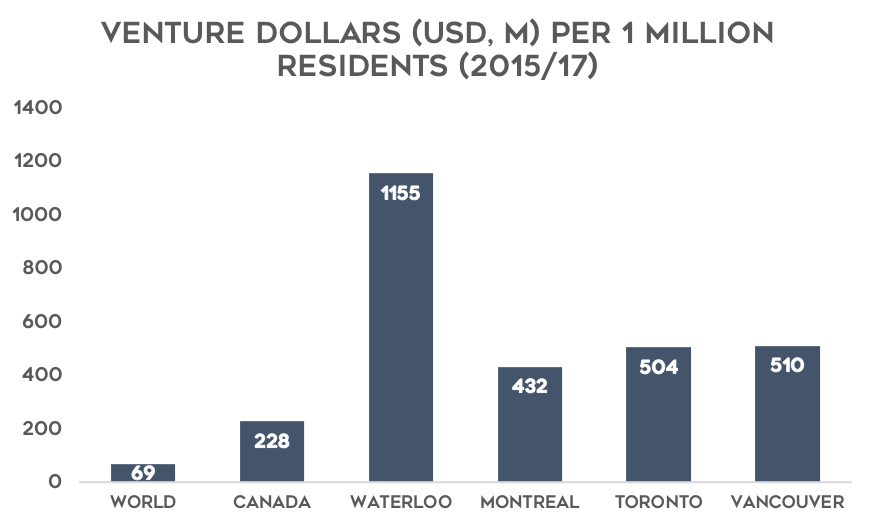

When it comes to metro-wide density measures, Waterloo is by far the leader in Canada. Granted, there are reasons why city-wide population might not be the best denominator to get at startup density, but it’s a reasonable (and available) proxy so I'm going to use it. Entrepreneurial density is crucial, and in cities above a minimum size threshold, it can mark the reaching of a critical mass of activity. Waterloo has reached that mark.

Toronto, Vancouver, and Montreal are the main drivers of startup activity in Canada, and that can be expected to continue. And, even on a population-adjusted basis, Waterloo is still quite a ways behind leading small startup cities in the US (Boulder, Durham, Ann Arbor, Santa Barbara, Provo, and Madison) and in the UK (Cambridge and Oxford).

Even so, there is a lot great momentum in Waterloo, and given its existing strengths in computer science, entrepreneurship, and community building, I am optimistic about its future and look forward to watching it unfold. I have spoken to a number of amazing people from that region who are working hard to achieve great things. And they're doing it.